Finance is a key factor which plays a huge role in the development of an individual, thereby promoting the growth of a nation. But, earning ample amount of money is not the sole solution of having a settled future rather stress should be given on the ways of managing money.

However, money management is not a cheese-walk. You need to have a proper idea about everything before you can plan about stocking money for future use. To have all the required ideas, one need to be financially literate, which is not the case with everyone.

Another factor which needs to be changed is that most theories talk about securing the money of those people who are already rich and entirely ignore that bit of population who are poor both economically and educationally. For the betterment of a nation, all the sects of that particular space need to be accommodated and addressed and pushed towards development.

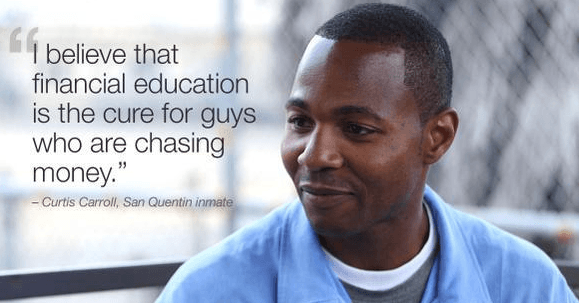

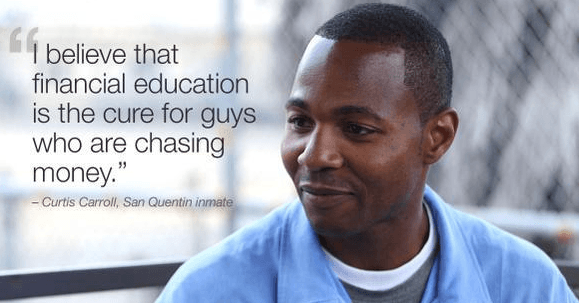

Surprisingly, this basic thought was processed by a mind that belongs to a person who has been serving his 54 years of life imprisonment in San Quentin, a den for correcting notorious criminals in California. The person in the spotlight is Curtis Carroll, and it is his notions about finance that has stirred the people,

and now they are accepting and going through his views. Before knowing what is being conjured, it is better to meet the conjurer.

About Mr Wall Street

Curtis was a street-rat who, deprived by destiny, had to fight with cursed circumstances to make a living, well, if you can call it so. At a very tender age, he was pushed towards crime so as to earn money to carry out a living. And as he was devoid of any education, he had no other option to make money. He did robberies, got caught, was released but was again forced to pursue the same route.

While doing so, he was convicted of killing a person with gunshot during the robbery and was sentenced to jail. All this at the age of seventeen only! But little did he know what life has already planned for him. Being illiterate, he used to learn about the happenings outside through an inmate’s reading of the newspaper.

One day, accidentally, he grabbed the business page and was questioned by another inmate, and from there he gathered a vague idea about stocks. The word ‘money’ intrigued him, and when he came to know that the white men keep their money in stocks, he was all the more eager. Slowly, he learned spelling, reading and devoured anything he could lay his hands upon and via this, he was able to accumulate enough knowledge about trading stocks. Once he was satiated with sufficient knowledge, he shared his ideas and his fellow convicts also showed the same enthusiasm which pushed Curtis to arrange workshops to propagate his idea.

Of course, the prison officials helped him and also encouraged him to go forward.

And this is how, a person with his back against the wall, turned around and became the ‘Wall Street’.

His vision and mission

Curtis understood that a convict gets to earn a good share of money through prison employments, but they are not capable of saving the money for future. So, ultimately when they are released, they are given a set amount of money to pass their days. The convicts then have no options of livelihood in front of them. Neither can they work nor do they want to get back to that old criminal life of theirs. So, to ease this issue, Curtis began teaching these imprisoned men the tactics of saving money.

A disease that destroys

Curtis realised that illiteracy in the matters of finance is no less than a disease as this is capable of destroying lives. The deprived people, (lower class, minorities, etc.) being unaware of the actual scenario, succumb to the pressure and because they have no money, they cannot enjoy their basic rights.

It is true money cannot buy everything but that is easy to say when you have something, but these people have access to nothing as they cannot afford the money. This situation, in an economically prosperous country, is a matter of concern as this shakes the foundation of public security and safety.

Need to FEEL

To address the ill-issues, Carroll formulated a program called FEEL- Financial Empowerment Emotional Literacy. This program zeroes in four key factors essential for the incarcerated men to thrive happily in the society after the sentence is over. These are:

- Save in a proper way

- Control cost of livelihood

- Effective borrowing of money

- Diversifying the savings

If people can follow these rules and learn how to separate their financial decisions from their emotional ones, then they will be happy and well placed for later in life. People should remember to make money work for them as that is the correct method, not the other way round.

A healthy lifestyle

Curtis urged the people to be stop being duped and take in what is happening. Financial literacy is just a lifestyle which can be enjoyed by those who are eager about that and this healthy lifestyle results into a robust financial stability which is of immense help to oneself and to society.

An economically stable person pays taxes and abides by the rules, thereby helping the society to be free of problems and crimes. A crime can never help someone to live a content life. The key to a happy life is taking responsibility and managing your matters.

Curtis Carroll would have remained in oblivion, and his talent would have been wasted, but thankfully, that did not happen. He is indeed a pioneer who bettered the life of so many people. Not only his inmates but many outsiders have been influenced by his idea.

He turned the imprisoned hapless people into professionals who can trade in stocks and manage their assets. Himself staying in a correctional home, he tried to correct the society’s attitude towards finance and incorporated a community feeling among the convicts!

Leave a Reply